Once considered niche, EVs were initially promoted as luxury cars with a six-figure sticker price. Today, the growing number of public charging stations and lower costs make EVs a compelling option for car shoppers. There are now several rebates that can make the cost of buying or leasing an EV even less than a gas-fueled car for some drivers.

Before you choose your next car, learn about the top three ways an EV can reduce your car expenses:

1. EV-exclusive Rebates Lower Car Purchasing/Leasing Costs

Remarkably, there are seven EV incentives available. What’s even better is several of these rebates can be combined to significantly reduce the cost of purchasing or leasing an EV.

If you’re on a tight budget you may qualify for several of the rebates listed – look for the words “income-qualified.” The list includes the MCEv vehicle rebate, which offers $3,500 for income-qualifying customers to help both lower the price and ease the process of buying or leasing an EV.

Here are two examples of how rebates can reduce the cost of EVs*:

- Jose is an MCE customer. He’s single and makes $70,000 per year. He’s considering a 2020 Nissan Leaf since it can travel 226 miles on a single battery charge, which is farther than his current gas car can go before he needs to fill up the tank. He could qualify for up to $10,300 in incentives, which is nearly 1/3 of the MSRP (aka sticker price).

- Margaret and Marcus are MCE customers and have a teenager at home. They are on a tight budget, with a combined income of $60,000 per year. They currently drive a 2004 gas car that they worry about every year ahead of emissions testing. They would qualify for at least $8,800 in incentives (including the MCEv Vehicle Rebate) and – if they scrap their current car – would get an additional $7,500 grant toward an EV, plus a free home charger.

2. Gas Costs Significantly More than Renewable Energy to Fill Up a Tank

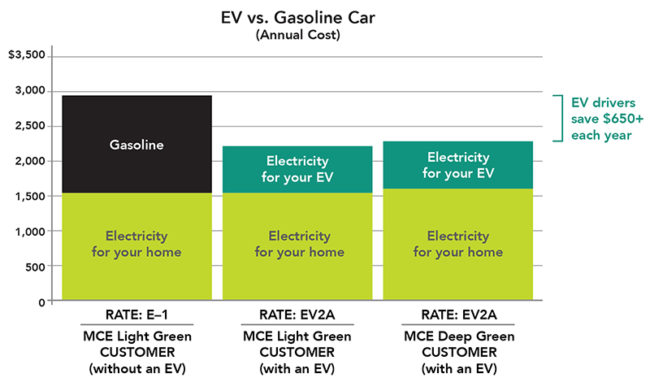

Gas car drivers pay about 200% more annually to fill their tanks, compared to those who drive EVs and charge up with MCE’s Deep Green 100% renewable energy**. That means you would need to spend just over $650 more each year to fuel up a gas car than an EV.

As seen above, charging at home can result in a slightly higher electricity bill for EV drivers, however any increase in electricity costs are outweighed by the savings from avoiding the gas station altogether. So even with a slightly higher electricity bill, EV drivers see significant savings annually.

3. EVs Need Less Maintenance

Imagine no longer having to pay for oil changes, smog checks, and new spark plugs, air filters, and belts. EVs don’t require the kind of regular maintenance that we’re used to with gas cars. By comparison, the only regular maintenance EVs need is adjusting tire pressure and rotating the tires. While you may have heard concerns about replacing EV batteries, a top vehicle history database reported, “Automakers cover the lithium-ion battery pack under warranty for an extended period to afford added peace-of-mind. This is generally for at least eight years or 100,000 miles, whichever comes first. California mandates that automakers extend the battery coverage for electric vehicles sold within the state to 10 years or 150,000 miles.”

Gas-fueled cars have more than 2,000 moving parts, while EVs only have about 20. That means the risk of a gas car having unexpected maintenance issues is 100 times higher, which could result in unplanned trips and payments to the mechanic.